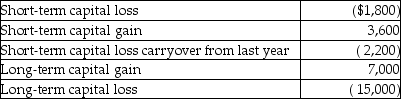

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

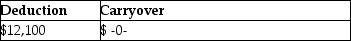

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

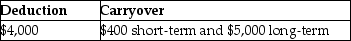

A)

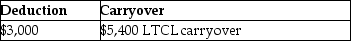

B)

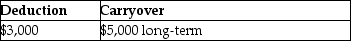

C)

D)

Correct Answer:

Verified

Q44: Melody inherited 1,000 shares of Corporation Zappa

Q52: In a common law state,jointly owned property

Q55: Joycelyn gave a diamond necklace to her

Q57: In a community property state,jointly owned property

Q58: Josh purchases a personal residence for $278,000

Q83: Gertie has a NSTCL of $9,000 and

Q85: Antonio is single and has taxable income

Q91: Andrea died with an unused capital loss

Q100: To be considered a Section 1202 gain,the

Q107: Amanda,whose tax rate is 33%,has NSTCL of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents