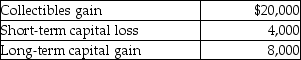

Kendrick,who has a 35% marginal tax rate,had the following results from transactions during the year:  After offsetting the STCL,what is (are) the resulting gain(s) ?

After offsetting the STCL,what is (are) the resulting gain(s) ?

A) $16,000 collectibles gain,$8,000 LTCG

B) $20,000 collectibles gain,$4,000 LTCG

C) $24,000 LTCG

D) $20,000 collectibles gain,$8,000 LTCG

Correct Answer:

Verified

Q78: Kate subdivides land held as an investment

Q90: The taxable portion of a gain from

Q94: Renee is single and has taxable income

Q95: This year,Lauren sold several shares of stock

Q96: Sanjay is single and has taxable income

Q97: Mike,a dealer in securities and calendar-year taxpayer,purchased

Q100: Nate sold two securities in 2013:

Q102: Margaret died on September 16,2013,when she owned

Q103: On July 25,2012,Marilyn gives stock with a

Q107: On January 31 of the current year,Sophia

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents