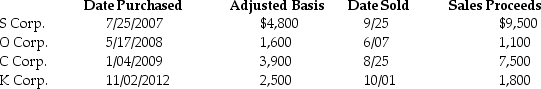

Mike sold the following shares of stock in 2013:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

Q70: Emma Grace acquires three machines for $80,000,which

Q78: Gina owns 100 shares of XYZ common

Q101: Melanie,a single taxpayer,has AGI of $220,000 which

Q102: Margaret died on September 16,2013,when she owned

Q103: On July 25,2012,Marilyn gives stock with a

Q105: On January 31,2013,Mallory pays $800 for an

Q107: On January 31 of the current year,Sophia

Q108: Niral is single and provides you with

Q111: Chen had the following capital asset transactions

Q120: On January 31 of this year,Jennifer pays

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents