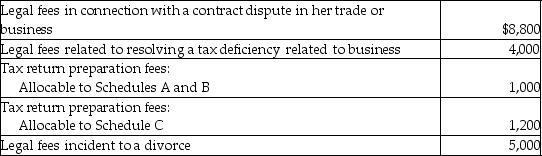

Leigh pays the following legal and accounting fees during the year:  What is the total amount of her for AGI deduction for these fees?

What is the total amount of her for AGI deduction for these fees?

A) $10,800

B) $14,000

C) $15,000

D) $20,000

Correct Answer:

Verified

Q12: Deductions for AGI may be located

A)on the

Q15: Self-employed individuals may claim,as a deduction for

Q15: On Form 1040,deductions for adjusted gross income

Q23: Mark and his brother,Rick,each own farms.Rick is

Q25: Laura,the controlling shareholder and an employee of

Q25: During the current year,Martin purchases undeveloped land

Q27: To be tax deductible,an expense must be

Q50: In 2013,Venkat,who is single and age 37,received

Q51: In 2013,Sean,who is single and age 44,received

Q57: Maria pays the following legal and accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents