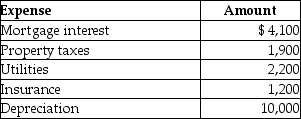

Abby owns a condominium in the Great Smokey Mountains.During the year,Abby uses the condo a total of 21 days.The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500.Abby incurs the following expenses:  Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

A) $ 5,074.

B) $ 8,515.

C) $ 7,900.

D) $10,000.

Correct Answer:

Verified

Q85: Sheila sells stock,which has a basis of

Q88: Mackensie owns a condominium in the Rocky

Q95: Bart operates a sole proprietorship for which

Q97: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q101: Donald sells stock with an adjusted basis

Q110: Samuel,a calendar year taxpayer,owns 100 shares of

Q114: Juanita knits blankets as a hobby and

Q114: Erin,Sarah,and Timmy are equal partners in EST

Q115: Jason sells stock with an adjusted basis

Q128: Vanessa owns a houseboat on Lake Las

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents