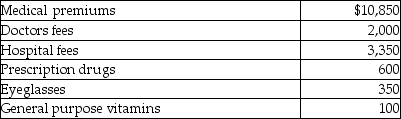

Mitzi's medical expenses include the following:  Mitzi's AGI for the year is $33,000.She is single and age 49.None of the medical costs are reimbursed by insurance.After considering the AGI floor,Mitzi's medical expense deduction is

Mitzi's AGI for the year is $33,000.She is single and age 49.None of the medical costs are reimbursed by insurance.After considering the AGI floor,Mitzi's medical expense deduction is

A) $12,9000.

B) $13,850.

C) $14,675.

D) $16,325.

Correct Answer:

Verified

Q36: Doug pays a county personal property tax

Q41: Mr.and Mrs.Thibodeaux,who are filing a joint return,have

Q42: Caleb's medical expenses before reimbursement for the

Q44: In 2013,Carlos filed his 2012 state income

Q46: Mr.and Mrs.Gere,who are filing a joint return,have

Q47: In 2013 Sela traveled from her home

Q48: On September 1,of the current year,James,a cash-basis

Q49: In February of the current year (assume

Q49: Matt paid the following taxes:

Q53: Interest expense incurred in the taxpayer's trade

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents