On September 1,of the current year,Samuel,a cash-basis taxpayer,sells his farm to Edward,also a cash-basis taxpayer for $100,000.Samuel's basis in the farm is $65,000.The real property tax year is the calendar year.Real estate taxes on the property for the year are $3,650 and are payable on April 1 of the following year.The sales agreement does not provide for apportionment of real estate taxes between the buyer and seller.Assume Samuel pays all of the real estate taxes prior to the sale.The effects of this sales structure will be:

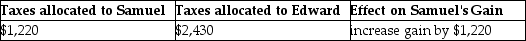

A)

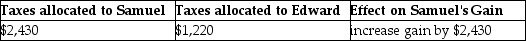

B)

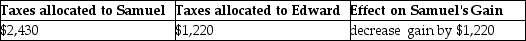

C)

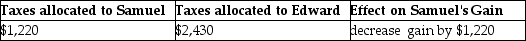

D)

Correct Answer:

Verified

Q9: Leo spent $6,600 to construct an entrance

Q19: All of the following payments for medical

Q30: Linda had a swimming pool constructed at

Q36: Doug pays a county personal property tax

Q46: Mr.and Mrs.Gere,who are filing a joint return,have

Q47: In 2013 Sela traveled from her home

Q48: On September 1,of the current year,James,a cash-basis

Q49: Matt paid the following taxes:

Q54: During the year Jason and Kristi,cash basis

Q55: A review of the 2013 tax file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents