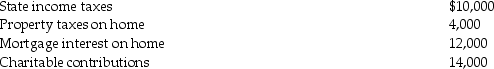

Tasneem,a single taxpayer has paid the following amounts this year:  Tasneem's AGI is $360,000.What is her net itemized deduction allowed?

Tasneem's AGI is $360,000.What is her net itemized deduction allowed?

A) $40,000

B) $38,200

C) $36,700

D) None of the above.

Correct Answer:

Verified

Q57: Peter is assessed $630 for street improvements

Q61: Dana paid $13,000 of investment interest expense

Q68: On July 31 of the current year,Marjorie

Q74: In the current year,Julia earns $9,000 in

Q85: Hugh contributes a painting to a local

Q86: On December 1,2012,Delilah borrows $2,000 from her

Q100: Clayton contributes land to the American Red

Q109: Which of the following is not required

Q270: Discuss the timing of the allowable medical

Q276: Patrick and Belinda have a twelve- year-

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents