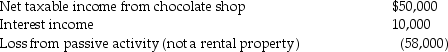

Hersh realized the following income and loss this year:

a.Assume Hersh is an individual taxpayer and the chocolate shop is his sole proprietorship.Determine Hersh's AGI and any carryovers.

a.Assume Hersh is an individual taxpayer and the chocolate shop is his sole proprietorship.Determine Hersh's AGI and any carryovers.

b.Assume the taxpayer is Hersh Inc.,a C corporation,owned 100% by the Hersh family.Determine Hersh Inc.'s taxable income and any carryovers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Adam owns interests in partnerships A and

Q94: Determine the net deductible casualty loss on

Q96: Frank loaned Emma $5,000 in 2011 with

Q97: Becky,a single individual,reports the following taxable items

Q106: A taxpayer incurs a net operating loss

Q108: An individual taxpayer has negative taxable income

Q124: What must an individual taxpayer prove to

Q125: How is a claim for refund of

Q229: What are some factors which indicate that

Q232: If a loan has been made to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents