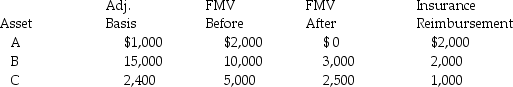

Wes owned a business which was destroyed by fire in May 2013.Details of his losses follow:

His AGI without consideration of the casualty is $45,000.

His AGI without consideration of the casualty is $45,000.

What is Wes's net casualty loss deduction for 2013?

Correct Answer:

Verified

Q76: Aretha has AGI of less than $100,000

Q82: In 2012 Grace loaned her friend Paula

Q83: Martha,an accrual-method taxpayer,has an accounting practice.In 2012,she

Q84: In October 2013,Jonathon Remodeling Co.,an accrual-method taxpayer,remodels

Q85: Kendal reports the following income and loss:

Q88: During the year,Patricia realized $10,000 of taxable

Q90: Harley,a single individual,provided you with the following

Q91: Parveen is married and files a joint

Q92: Which of the following expenses or losses

Q129: Businesses can recognize a loss on abandoned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents