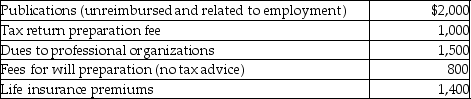

West's adjusted gross income was $90,000.During the current year he incurred and paid the following:  Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

A) $2,700

B) $4,500

C) $3,500

D) $5,300

Correct Answer:

Verified

Q36: Gwen traveled to New York City on

Q42: Which of the following statements regarding independent

Q44: In which of the following situations is

Q49: A qualified pension plan requires that employer-provided

Q50: Nonqualified deferred compensation plans can discriminate in

Q51: Under a qualified pension plan,the employer's deduction

Q54: All of the following are allowed a

Q59: A contributor may make a deductible contribution

Q80: All taxpayers are allowed to contribute funds

Q82: An employer receives an immediate tax deduction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents