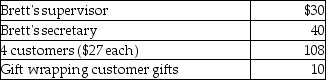

Brett,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

A) $135

B) $150

C) $170

D) $180

Correct Answer:

Verified

Q31: Norman traveled to San Francisco for four

Q58: Matt is a sales representative for a

Q69: Chelsea,who is self-employed,drove her automobile a total

Q70: Donald takes a new job and moves

Q73: Rajiv,a self-employed consultant,drove his auto 20,000 miles

Q75: Ron obtained a new job and moved

Q75: All of the following may deduct education

Q77: Joe is a self-employed tax attorney who

Q78: Steven is a representative for a textbook

Q80: In which of the following situations is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents