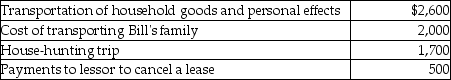

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

A) $2,600

B) $4,600

C) $6,300

D) $6,800

Correct Answer:

Verified

Q31: Gayle,a doctor with significant investments in the

Q42: Which of the following statements regarding independent

Q45: Alex is a self-employed dentist who operates

Q59: A contributor may make a deductible contribution

Q60: Sarah incurred employee business expenses of $5,000

Q61: Austin incurs $3,600 for business meals while

Q62: Jordan,an employee,drove his auto 20,000 miles this

Q67: Edward incurs the following moving expenses:

Q77: The following individuals maintained offices in their

Q80: All taxpayers are allowed to contribute funds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents