Martin Corporation granted a nonqualified stock option to employee Caroline on January 1,2011.The option price was $150,and the FMV of the Martin stock was also $150 on the grant date.The option allowed Caroline to purchase 1,000 shares of Martin stock.The option itself does not have a readily ascertainable FMV.Caroline exercised the option on August 1,2013 when the stock's FMV was $250.If Caroline sells the stock on September 5,2014 for $300 per share,she must recognize

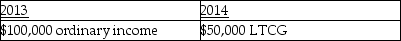

A)

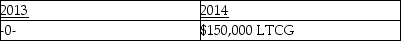

B)

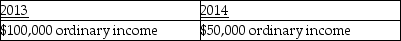

C)

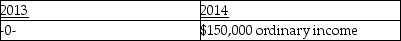

D)

Correct Answer:

Verified

Q64: Tobey receives 1,000 shares of YouDog! stock

Q66: Characteristics of profit-sharing plans include all of

Q71: All of the following characteristics are true

Q72: Wilson Corporation granted an incentive stock option

Q77: In a contributory defined contribution pension plan,all

Q87: Jackson Corporation granted an incentive stock option

Q89: Ross works for Houston Corporation,which has a

Q91: Martin Corporation granted an incentive stock option

Q94: Tessa is a self-employed CPA whose 2013

Q97: Frank is a self-employed CPA whose 2012

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents