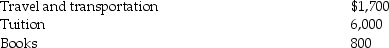

Ellie,a CPA,incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by his employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: What factors are considered in determining whether

Q47: Charles is a self-employed CPA who maintains

Q63: What two conditions are necessary for moving

Q82: All of the following are true with

Q83: Which of the following is true about

Q100: Tyne is a 48-year-old an unmarried taxpayer

Q102: Ruby Corporation grants stock options to Iris

Q104: Feng,a single 40 year old lawyer,is covered

Q108: During 2013,Marcia,who is single and is covered

Q120: Hunter retired last year and will receive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents