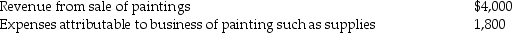

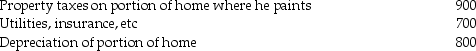

Dighi,an artist,uses a room in his home (250 square feet)as a studio exclusively to paint.The studio meets the requirements for a home office deduction.(Painting is considered his trade or business.)The following information appears in Dighi's records:

Expenses related to home office:

Expenses related to home office:

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(b)If some amount is not allowed under the tax law,how is the disallowed amount treated?

(c)Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill.How much of a home office deduction,if any,will he be allowed?

Correct Answer:

Verified

Limited to:

$2,200 will be deducted...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: What factors are considered in determining whether

Q64: Explain when educational expenses are deductible for

Q82: All of the following are true with

Q97: Which of the following statements regarding Coverdell

Q108: During 2013,Marcia,who is single and is covered

Q109: Richard traveled from New Orleans to New

Q112: Tucker (age 52)and Elizabeth (age 48)are a

Q113: Which of the following statements regarding Health

Q114: Sarah purchased a new car at the

Q141: Jack takes a $7,000 distribution from his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents