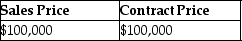

This year,John purchased property from William by assuming an existing mortgage of $40,000 and agreed to pay an additional $60,000,plus interest,in the 3 years following the year of sale (i.e.$20,000 annual payments for three years,plus interest) .William had an adjusted basis of $44,000 in the building.What are the sales price and the contract price in this transaction?

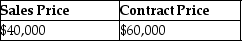

A)

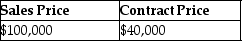

B)

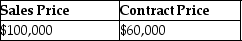

C)

D)

Correct Answer:

Verified

Q64: On July 25 of this year,Raj sold

Q66: The installment method may be used for

Q67: Freida is an accrual-basis taxpayer who owns

Q68: The look-back interest adjustment involves the

A)calculation of

Q72: An installment sale is best defined as

A)any

Q77: The installment sale method can be used

Q83: On June 11,two years ago,Gia sold land

Q85: On June 11 of last year,Derrick sold

Q97: On May 18,of last year,Yuji sold unlisted

Q97: On May 18 of last year,Carter sells

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents