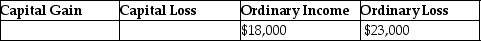

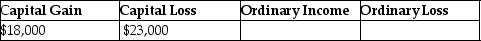

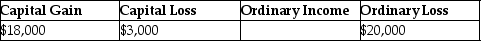

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses.The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Q3: During the current year,George recognizes a $30,000

Q25: Gifts of appreciated depreciable property may trigger

Q32: Dinah owned land with a FMV of

Q33: If Section 1231 applies to the sale

Q37: In order to be considered Sec.1231 property,all

Q45: An unincorporated business sold two warehouses during

Q59: During the current year,Hugo sells equipment for

Q70: Frisco Inc.,a C corporation,placed a building in

Q82: Gain recognized on the sale or exchange

Q93: If no gain is recognized in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents