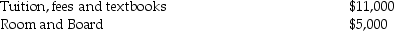

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2013:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Annie has taxable income of $100,000,a regular

Q90: Sonya started a self-employed consulting business in

Q92: If a taxpayer's AGI is greater than

Q96: Lara started a self-employed consulting business in

Q101: Sam and Megan are married with two

Q109: With respect to estimated tax payments for

Q110: An individual with AGI equal to or

Q111: Which of the following expenditures will qualify

Q113: Dwayne has general business credits totaling $30,000

Q118: Which one of the following is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents