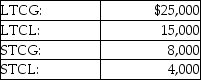

A corporation has the following capital gains and losses during the current year:  The tax result to the corporation is

The tax result to the corporation is

A) $10,000 NLTCG included in gross income and taxed at ordinary rates; $4,000 NSTCG included in gross income and taxed at reduced rates.

B) $14,000 included in gross income and taxed at reduced rates.

C) $14,000 included in gross income and taxed at ordinary rates.

D) $10,000 NLTCG is included in gross income and taxed at reduced rates; and $4,000 NSTCG included in gross income and taxed at ordinary rates.

Correct Answer:

Verified

Q23: Charades Corporation is a publicly held company

Q37: If a corporation's charitable contributions exceed the

Q41: If a corporation distributes appreciated property to

Q43: Summer Corporation has the following capital gains

Q45: All of the following business forms offer

Q46: Musketeer Corporation has the following income and

Q47: June Corporation has the following income and

Q48: By calculating its depreciation using the most

Q55: Corporations that are members of a parent-subsidiary

Q113: A shareholder receives a distribution from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents