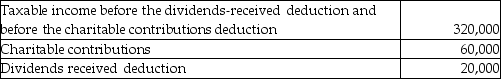

Louisiana Land Corporation reported the following results for the current year:  What is the amount of the taxable income for the current year?

What is the amount of the taxable income for the current year?

A) $240,000

B) $268,000

C) $294,000

D) $300,000

Correct Answer:

Verified

Q8: All of the following are accurate statements

Q21: Identify which of the following statements is

Q50: A corporation redeems 10 percent of the

Q50: With respect to charitable contributions by corporations,

Q52: Jenkins Corporation has the following income and

Q53: For this tax year,Madison Corporation had taxable

Q53: Charades Corporation is a publicly held company

Q58: Corey Corporation reported the following results for

Q59: A corporation has the following capital gains

Q105: Dividends paid from E&P are taxable to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents