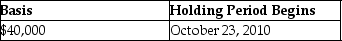

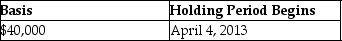

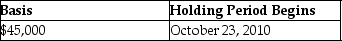

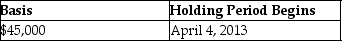

On April 4,2013,Joan contributes business equipment (she had purchased on October 23,2010) having a $45,000 FMV and a $40,000 adjusted basis to the EJK Partnership in exchange for a 25% interest in the capital and profits.The basis of the property and the date the holding period begins for the partnership is

A)

B)

C)

D)

Correct Answer:

Verified

Q61: In the syndication of a partnership,brokerage and

Q74: David and Joycelyn form an equal partnership

Q76: Richard has a 50% interest in a

Q78: Atiqa receives a nonliquidating distribution of land

Q78: All of the following statements are true

Q81: Bryan Corporation,an S corporation since its organization,is

Q83: Which of the following assets may cause

Q84: Worthy Corporation elected to be taxed as

Q91: On January 1 of this year (assume

Q133: All of the following would reduce the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents