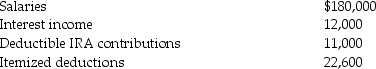

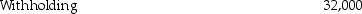

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2014. Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Q83: In order to shift the taxation of

Q106: Married couples will normally file jointly.Identify a

Q107: A taxpayer can receive innocent spouse relief

Q115: In 2014,Sam is single and rents an

Q116: Lila and Ted are married and have

Q120: Adam attended college for much of 2014,during

Q122: Kelsey is a cash-basis,calendar-year taxpayer.Her salary is

Q123: Paul and Hannah,who are married and file

Q1021: Oscar and Diane separated in June of

Q1038: Alexis and Terry have been married five

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents