Yenhung,who is single,forms a corporation using a tax-free asset transfer,which qualifies under Sec.351.She contributes property having an adjusted basis of $50,000 and an FMV of $40,000.The stock received from the corporation is Sec.1244 stock.When Yenhung sells the stock for $30,000,her loss is

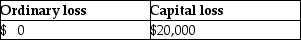

A)

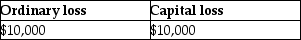

B)

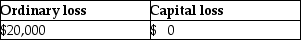

C)

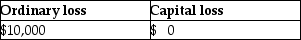

D)

Correct Answer:

Verified

Q42: Jeremy transfers Sec. 351 property acquired three

Q45: Ralph transfers property with an adjusted basis

Q69: Identify which of the following statements is

Q70: Identify which of the following statements is

Q73: Mario and Lupita form a corporation in

Q74: Lynn transfers land having a $50,000 adjusted

Q75: A medical doctor incorporates her medical practice,

Q78: The transferor's holding period for any boot

Q107: Identify which of the following statements is

Q110: The City of Springfield donates land worth

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents