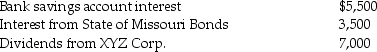

Kevin is a single person who earns $70,000 in salary for 2014 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2013 tax returns in April of 2014.His federal refund was $600 and his state refund was $300.Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2013 return. Due to changes in circumstances,Kevin is not itemizing deductions on his 2014 return.

Kevin received tax refunds when he filed his 2013 tax returns in April of 2014.His federal refund was $600 and his state refund was $300.Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2013 return. Due to changes in circumstances,Kevin is not itemizing deductions on his 2014 return.

Compute Kevin's taxable income for 2014.

Correct Answer:

Verified

Q125: Edward is considering returning to work part-time

Q129: Which of the following constitutes constructive receipt

Q130: Buzz is a successful college basketball coach.

Q132: Jeannie,a single taxpayer,retired during the year,to take

Q141: While certain income of a minor is

Q143: Adanya's marginal tax rate is 39.6% and

Q789: James and Colleen have reached an agreement

Q793: Raoul sells household items on an Internet

Q796: Aaron found a prototype of a new

Q904: Billy, age 10, found an old baseball

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents