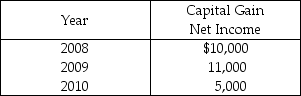

Evans Corporation has a $15,000 net capital loss in 2011.The corporation reported the following capital gain net income during the past three years.Identify which of the following statements is true.

A) The loss is used to offset the gains from 2010 and then carried back to offset $10,000 of the gains in 2008.

B) The loss is used to offset the $11,000 of the 2009 gains and then carried back to offset $4,000 of the year 2008 net gain.

C) The loss is used to offset $3,000 of the current year ordinary income,all of the year 2008 capital gains,and $7,000 of the year 2009 net gain.

D) The loss is used to offset the year 2008 net gains,then $5,000 of the year 2009 net gains.

Correct Answer:

Verified

Q7: Identify which of the following statements is

Q8: A new corporation may generally select one

Q11: Trail Corporation has gross profits on sales

Q18: An election to forgo an NOL carryback

Q31: Identify which of the following statements is

Q36: Super Corporation gives a painting to a

Q40: Identify which of the following statements is

Q108: A deferred tax asset indicates that a

Q109: Which of the following items indicate that

Q111: Which of the following statements is correct?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents