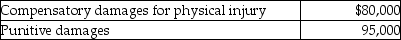

Derrick was in an automobile accident while he was going to work.The doctor advised him to stay home for eight months due to his physical injuries.The resulting lawsuit was settled and Derrick received the following amounts:  How much of the settlement must Derrick include in ordinary income on his tax return?

How much of the settlement must Derrick include in ordinary income on his tax return?

A) $0

B) $80,000

C) $95,000

D) $175,000

Correct Answer:

Verified

Q32: "No additional cost" benefits are excluded from

Q41: Mae Li is beneficiary of a $70,000

Q42: David has been diagnosed with cancer and

Q46: Greg is the owner and beneficiary of

Q47: Britney is beneficiary of a $150,000 insurance

Q48: Amanda,who lost her modeling job,sued her employer

Q52: Bret carries a $200,000 insurance policy on

Q54: Which of the following statements regarding qualified

Q54: Hope receives an $18,500 scholarship from State

Q58: Rebecca is the beneficiary of a $500,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents