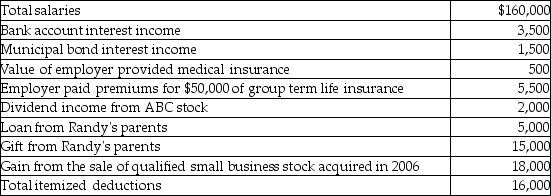

Randy and Sharon are married and have two dependent children.They also fully support Sharon's mother who lives with them and has no income.Their 2014 tax and other related information is as follows:

Compute Randy and Sharon's taxable income.(Show all calculations in good form.)

Compute Randy and Sharon's taxable income.(Show all calculations in good form.)

Correct Answer:

Verified

Q82: After he was denied a promotion,Daniel sued

Q87: In 2006,Gita contributed property with a basis

Q89: Adam purchased stock in 2006 for $100,000.He

Q91: Bob,an employee of Modern Corp.,receives a fringe

Q92: This year,Jason sold some qualified small business

Q93: In September of 2014,Michelle sold shares of

Q95: In 2013 Betty loaned her son,Juan,$10,000 to

Q96: For a taxpayer who is not insolvent

Q96: Exter Company is experiencing financial difficulties.It has

Q99: Connor owes $4 million and has assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents