Perch Corporation has made paint and paint brushes for the past ten years.Perch Corporation is owned equally by Arnold,an individual,and Acorn Corporation.Perch Corporation has $100,000 of accumulated and current E&P.Both Arnold and Acorn Corporation have a basis in their stock of $10,000.Perch Corporation discontinues the paint brush operation and distributes assets worth $10,000 each to Arnold and Acorn Corporation in redemption of 20% of their stock.Due to the distribution,Arnold and Acorn Corporation must report:

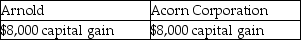

A)

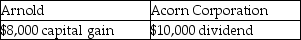

B)

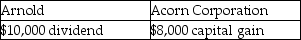

C)

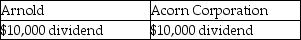

D)

Correct Answer:

Verified

Q21: Splash Corporation has $50,000 of taxable income

Q40: When computing E&P and taxable income, different

Q63: Identify which of the following statements is

Q63: Omega Corporation is formed in 2006.Its current

Q64: Identify which of the following statements is

Q72: Identify which of the following statements is

Q82: All of Sphere Corporation's single class of

Q84: Blast Corporation manufactures purses and make-up kits.

Q92: Identify which of the following statements is

Q98: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents