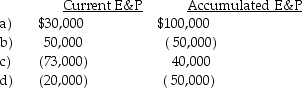

Green Corporation is a calendar-year taxpayer.All of the stock is owned by Evan.His basis for the stock is $35,000.On March 1 (of a non-leap year),Green Corporation distributes $120,000 to Evan.Determine the tax consequences of the cash distribution to Evan in each of the following independent situations:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Gould Corporation distributes land (a capital asset)worth

Q47: In the current year, Red Corporation has

Q54: John, the sole shareholder of Photo Specialty

Q55: In the current year, Pearl Corporation has

Q70: Ace Corporation has a single class of

Q80: Checkers Corporation has a single class of

Q90: Stone Corporation redeems 1,000 share of its

Q92: Payment Corporation has accumulated E&P of $19,000

Q95: Peach Corporation was formed four years ago.Its

Q101: Susan owns 150 of the 200 outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents