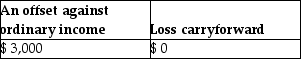

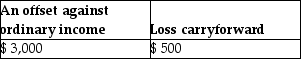

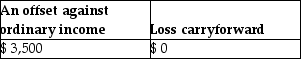

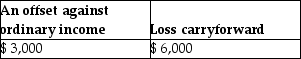

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year.After gains and losses are offset,Gertie reports

A)

B)

C)

D)

Correct Answer:

Verified

Q41: Jessica owned 200 shares of OK Corporation

Q46: Bob owns 100 shares of ACT Corporation

Q51: In the current year,Andrew received a gift

Q58: Josh purchases a personal residence for $278,000

Q59: Tina purchases a personal residence for $278,000,but

Q65: All of the following are capital assets

Q75: Which one of the following is a

Q82: This year,Lauren sold several shares of stock

Q84: Nate sold two securities in 2014:

Q85: Antonio is single and has taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents