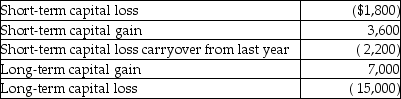

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

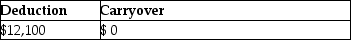

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

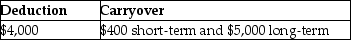

A)

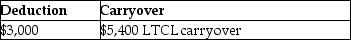

B)

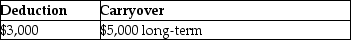

C)

D)

Correct Answer:

Verified

Q92: Joel has four transactions involving the sale

Q93: Darla sold an antique clock in 2014

Q96: Coretta sold the following securities during 2014:

Q98: Stella has two transactions involving the sale

Q99: Sari is single and has taxable income

Q100: To be considered a Section 1202 gain,the

Q100: Sanjay is single and has taxable income

Q101: On July 25,2013,Marilyn gives stock with a

Q102: Margaret died on September 16,2014,when she owned

Q102: Olivia,a single taxpayer,has AGI of $280,000 which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents