Rita,who has marginal tax rate of 39.6%,is planning to make a gift to her grandson who is in the lowest tax bracket.Which of the following holdings of stock would be the most tax advantageous gift from Rita's perspective?

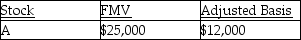

A)

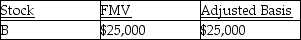

B)

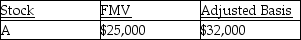

C)

D) For income tax purposes,Rita will be indifferent as to choice of stock to gift.

Correct Answer:

Verified

Q70: Emma Grace acquires three machines for $80,000,which

Q78: Gina owns 100 shares of XYZ common

Q88: Candice owns a mutual fund that reinvests

Q106: Topaz Corporation had the following income and

Q107: On January 31 of the current year,Sophia

Q107: On July 25,2013,Karen gives stock with a

Q107: Amanda,whose tax rate is 33%,has NSTCL of

Q111: Rita died on January 1,2014 owning an

Q127: How long must a capital asset be

Q135: Arthur,age 99,holds some stock purchased many years

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents