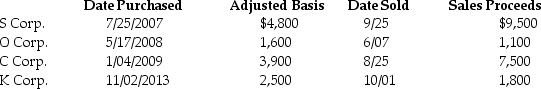

Mike sold the following shares of stock in 2014:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

Q101: Melanie,a single taxpayer,has AGI of $220,000 which

Q119: In the current year,ABC Corporation had the

Q126: Trista,a taxpayer in the 33% marginal tax

Q127: Chen had the following capital asset transactions

Q128: Niral is single and provides you with

Q129: Max sold the following capital assets this

Q564: Armanti received a football championship ring in

Q572: Distinguish between the Corn Products doctrine and

Q573: Donald has retired from his job as

Q643: What type of property should be transferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents