Beta Corporation incurs an $80,000 regular tax liability and a $20,000 AMT liability.Assuming no restrictions on Beta's ability to use the minimum tax credit,what journal entry would be necessary to record tax expense?

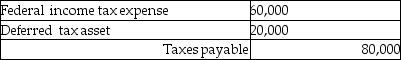

A)

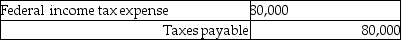

B)

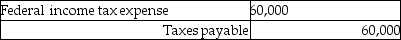

C)

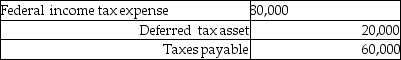

D)

Correct Answer:

Verified

Q2: Foster Corporation has gross income for regular

Q10: The personal holding company tax might be

Q10: Which of the following items are adjustments

Q27: Which of the following entities is subject

Q35: Mountaineer,Inc.has the following results: Q36: Mountaineer,Inc.has the following results: Q37: All of the following are recognized as Q38: Identify which of the following statements is Q40: Which of the following is not an Q102: ASC 740 requires that![]()

![]()

A)the AMT is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents