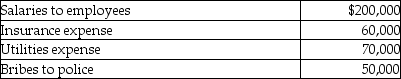

Troy incurs the following expenses in his business,an illegal gambling establishment:  His deductible expenses are

His deductible expenses are

A) $0.

B) $200,000.

C) $330,000.

D) $380,000.

Correct Answer:

Verified

Q23: Mark and his brother,Rick,each own farms.Rick is

Q25: During the current year,Martin purchases undeveloped land

Q51: Pat,an insurance executive,contributed $1,000,000 to the reelection

Q56: Sacha,a dentist,has significant investment assets.She holds corporate

Q62: On August 1 of this year,Sharon,a cash-method

Q66: Jimmy owns a trucking business.During the current

Q71: On July 1 of the current year,Marcia

Q73: Paul,a business consultant,regularly takes clients and potential

Q79: Jones,Inc.,a calendar-year taxpayer,is in the air conditioner

Q80: In which of the following situations are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents