Rob sells stock with a cost of $3,000 to his daughter for $2,200,which is its fair market value.Later the daughter sells the stock for $3,200 to an unrelated party.Which of the following describes the tax treatment to Rob and Daughter?

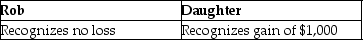

A)

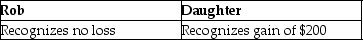

B)

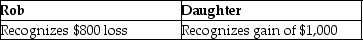

C)

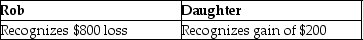

D)

Correct Answer:

Verified

Q61: Which of the following is not required

Q86: Ashley,a calendar year taxpayer,owns 400 shares of

Q87: Kyle drives a race car in his

Q93: Sheila sells stock,which has a basis of

Q94: Under the accrual method,recurring liabilities may be

Q94: For the years 2010 through 2014 (inclusive)Max,a

Q106: Dana purchased an asset from her brother

Q110: Which of the following individuals is not

Q118: Which of the following factors is not

Q135: Abigail's hobby is sculpting.During the current year,Abigail

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents