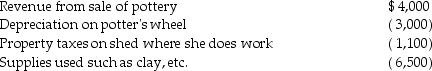

Margaret,a single taxpayer,operates a small pottery activity in her spare time.During the current year,she reported the following income and expenses from this activity which is classified as a hobby:

In addition,she had salary of $75,000 and itemized deductions,not including those listed above,of $2,200.

In addition,she had salary of $75,000 and itemized deductions,not including those listed above,of $2,200.

What is the amount of her taxable income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Nikki is a single taxpayer who owns

Q113: During the current year,Lucy,who has a sole

Q119: Abby owns a condominium in the Great

Q124: Gabby owns and operates a part-time art

Q128: Vanessa owns a houseboat on Lake Las

Q405: Ben is a well- known professional football

Q434: Super Development Company purchased land in the

Q483: During the current year, Jack personally uses

Q486: Explain the rules for determining whether a

Q497: Discuss tax planning considerations which a taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents