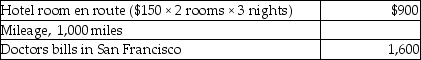

In 2014 Sela traveled from her home in Flagstaff to San Francisco to seek medical care.Because she was unable to travel alone,her mother accompanied her.Total expenses included:  The total medical expenses deductible before the 10% limitation are

The total medical expenses deductible before the 10% limitation are

A) $1,600.

B) $2,135.

C) $2,500.

D) $2,460.

Correct Answer:

Verified

Q9: Leo spent $6,600 to construct an entrance

Q19: All of the following payments for medical

Q30: Linda had a swimming pool constructed at

Q31: The following taxes are deductible as itemized

Q36: Doug pays a county personal property tax

Q47: A review of the 2014 tax file

Q49: In February of the current year (assume

Q50: Alan,who is a security officer,is shot while

Q54: During the year Jason and Kristi,cash basis

Q55: Mitzi's medical expenses include the following:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents