On September 1,of the current year,James,a cash-basis taxpayer,sells his farm to Bill,also a cash-basis taxpayer,for $100,000.James' basis in the farm is $65,000.The real property tax year is the calendar year.Real estate taxes on the property for the year are $3,650 and are payable in November of the current year.The sales agreement does not provide for apportionment of real estate taxes between the buyer and seller.Assume Bill pays all of the real estate taxes in the current year.The effects of this sales structure will be:

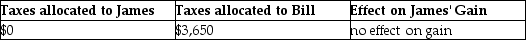

A)

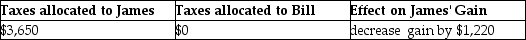

B)

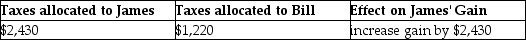

C)

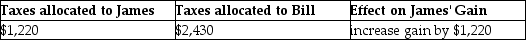

D)

Correct Answer:

Verified

Q46: When both borrowed and owned funds are

Q51: Hui pays self-employment tax on her sole

Q69: Leslie,who is single,finished graduate school this year

Q71: All of the following statements are true

Q73: On September 1,of the current year,Samuel,a cash-basis

Q74: In the current year,Julia earns $9,000 in

Q75: Faye earns $100,000 of AGI,including $90,000 of

Q76: Don's records contain the following information: 1.Donated

Q78: Which of the following is deductible as

Q79: Ted pays $2,100 interest on his automobile

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents