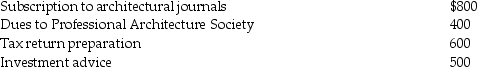

Wang,a licensed architect employed by Skye Architects,incurred the following unreimbursed expenses this year:  Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

A) $0

B) $1,900

C) $800

D) $1,500

Correct Answer:

Verified

Q83: Carol contributes a painting to a local

Q87: Grace has AGI of $60,000 in 2013

Q88: Hope is a marketing manager at a

Q90: Daniel had adjusted gross income of $60,000,which

Q92: Erin's records reflect the following information: 1.Paid

Q95: During 2014 Richard and Denisa,who are married

Q97: During the current year,Jane spends approximately 90

Q100: Clayton contributes land to the American Red

Q109: Which of the following is not required

Q116: Patrick's records for the current year contain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents