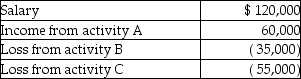

Joy reports the following income and loss:  Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.

Based on this information,Joy has

A) adjusted gross income of $90,000.

B) salary of $120,000 and deductible net losses of $30,000.

C) salary of $120,000 and net passive losses of $30,000 that will be carried over.

D) salary of $120,000,passive income of $60,000,and passive loss carryovers of $90,000.

Correct Answer:

Verified

Q7: Lucia owns 100 shares of Cronco Inc.which

Q8: Juan has a casualty loss of $32,500

Q19: The amount realized by Matt on the

Q37: During the year,Mark reports $90,000 of active

Q56: Which of the following is not generally

Q62: In February 2014,Amelia's home,which originally cost $150,000,is

Q76: A fire totally destroyed office equipment and

Q82: This summer,Rick's home (which has a basis

Q87: A net operating loss can be carried

Q90: Wesley completely demolished his personal automobile in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents