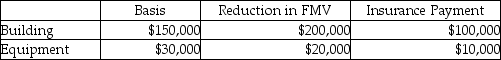

Lena owns a restaurant which was damaged by a tornado.The following assets were partially destroyed:  Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

A) $54,900

B) $60,000

C) $70,000

D) $180,000

Correct Answer:

Verified

Q43: Shaunda has AGI of $90,000 and owns

Q46: A taxpayer's rental activities will be considered

Q50: Joseph has AGI of $170,000 before considering

Q55: An individual is considered to materially participate

Q74: Jarrett owns a mountain chalet that he

Q74: Brandon,a single taxpayer,had a loss of $48,000

Q81: Martha,an accrual-method taxpayer,has an accounting practice.In 2013,she

Q83: Adam owns interests in partnerships A and

Q84: Parveen is married and files a joint

Q92: Which of the following expenses or losses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents