Martin Corporation granted a nonqualified stock option to employee Caroline on January 1,2011. The option price was $150,and the FMV of the Martin stock was also $150 on the grant date.The option allowed Caroline to purchase 1,000 shares of Martin stock. The option itself does not have a readily ascertainable FMV. Caroline exercised the option on August 1,2014 when the stock's FMV was $250.If Caroline sells the stock on September 5,2015 for $300 per share,she must recognize

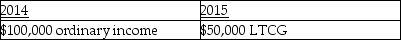

A)

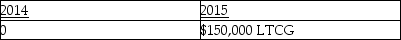

B)

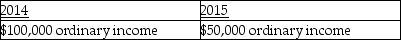

C)

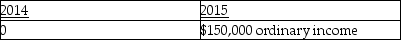

D)

Correct Answer:

Verified

Q64: Tobey receives 1,000 shares of YouDog! stock

Q77: In a contributory defined contribution pension plan,all

Q79: Donald takes a new job and moves

Q80: In which of the following situations is

Q82: Which of the following statements is incorrect

Q87: Tessa is a self-employed CPA whose 2014

Q88: Frank is a self-employed CPA whose 2014

Q89: Ross works for Houston Corporation,which has a

Q108: Characteristics of profit-sharing plans include all of

Q120: Which of the following statements is incorrect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents