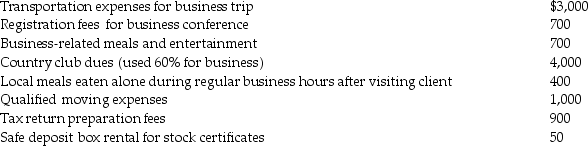

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Gina is an instructor at State University

Q64: Explain when educational expenses are deductible for

Q97: Which of the following statements regarding Coverdell

Q101: Which of the following conditions would generally

Q110: Daniel has accepted a new job and

Q116: H (age 50)and W (age 48)are married

Q117: David acquired an automobile for $30,000 for

Q118: Why did Congress establish Health Savings Accounts

Q119: Hannah is a 52-year-old an unmarried taxpayer

Q120: Johanna is single and self- employed as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents