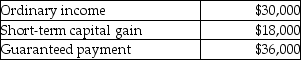

Brent is a general partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

A) $84,000

B) $66,000

C) $48,000

D) $36,000

Correct Answer:

Verified

Q7: Explain the difference between partnership distributions and

Q23: Jane contributes land with an FMV of

Q26: Bob contributes cash of $40,000 and Carol

Q48: Explain the tax consequences for both the

Q74: Brent is a limited partner in BC

Q84: The XYZ Partnership is held by ten

Q89: Identify which of the following statements is

Q97: Jangyoun sells investment land having a $30,000

Q99: The partners of the MCL Partnership, Martin,

Q100: When computing the partnership's ordinary income, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents