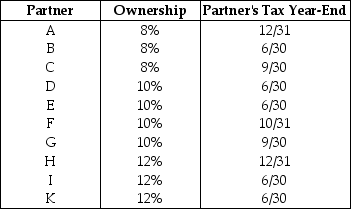

The XYZ Partnership is held by ten partners who have the following capital and profits ownership of the partnership.The tax year-end used by each of the ten partners is also indicated.Assume each partner has used this year-end for at least five years.

What is the required year-end for the XYZ Partnership,assuming that the business has no natural business year and has not filed a Sec.444 election?

What is the required year-end for the XYZ Partnership,assuming that the business has no natural business year and has not filed a Sec.444 election?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Explain the difference between partnership distributions and

Q10: Jeremey is a partner in the Jimimey

Q23: Jane contributes land with an FMV of

Q32: Sarah purchased land for investment in 2008

Q41: What are the three rules and their

Q48: Explain the tax consequences for both the

Q79: Brent is a general partner in BC

Q99: The partners of the MCL Partnership, Martin,

Q111: Edward owns a 70% interest in the

Q114: In January, Daryl and Louis form a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents