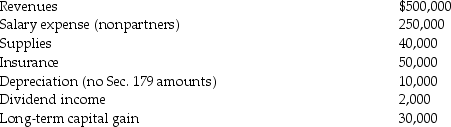

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Jeremey is a partner in the Jimimey

Q25: George receives a 10% limited partnership interest

Q49: Does the contribution of services to a

Q56: Charles Jordan files his income tax return

Q68: Briefly explain the aggregate and entity theories

Q73: Elijah contributes securities with a $90,000 FMV

Q74: What is included in partnership taxable income?

Q88: The Troika Partnership has an ordinary loss

Q91: The RT Limited Partnership incurs the following

Q94: Clark and Lewis are partners who share

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents