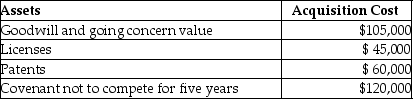

On January 1,2014,Charlie Corporation acquires all of the net assets of Rocky Corporation for $2,000,000.The following intangible assets are included in the purchase agreement:  What is the total amount of amortization allowed in 2014?

What is the total amount of amortization allowed in 2014?

A) $15,000

B) $22,000

C) $31,000

D) $38,000

Correct Answer:

Verified

Q41: Eric is a self-employed consultant.In May of

Q47: Atiqa took out of service and sold

Q62: Galaxy Corporation purchases specialty software from a

Q63: If the business usage of listed property

Q64: In the current year George,a college professor,acquired

Q66: Costs that qualify as research and experimental

Q67: This year Bauer Corporation incurs the following

Q69: Everest Corp.acquires a machine (seven-year property)on January

Q72: In August 2014,Tianshu acquires and places into

Q73: In April of 2013,Brandon acquired five-year listed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents