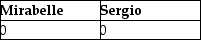

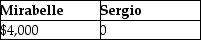

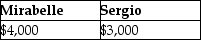

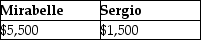

Mirabelle contributed land with a $5,000 basis and a $9,000 FMV to MS Partnership four years ago.This year the land is distributed to Sergio,another partner in the partnership.At the time of distribution,the land had a $12,000 FMV.How much gain should Mirabelle and Sergio recognize?

A)

B)

C)

D)

Correct Answer:

Verified

Q2: If a distribution occurs within _ years

Q4: Helmut contributed land with a basis of

Q5: John has a basis in his partnership

Q7: Susan contributed land with a basis of

Q9: If a partnership asset with a deferred

Q16: A partner's holding period for property distributed

Q20: Mirabelle contributed land with a $5,000 basis

Q25: For Sec. 751 purposes, "substantially appreciated inventory"

Q38: Under Sec. 751, unrealized receivables include potential

Q57: A partner can recognize gain, but not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents